Key Takeaways

1. Long-term investing outperforms short-term trading

"The average retail investor buying individual stocks made a return of just 2.1% per year."

Time in the market beats timing the market. Long-term investing allows you to benefit from compound growth and reduces the impact of short-term market fluctuations. By holding quality stocks for extended periods, you can:

- Minimize transaction costs and taxes

- Benefit from dividend growth over time

- Allow companies to execute their long-term strategies

Avoid the temptation to frequently buy and sell based on market sentiment or short-term news. Instead, focus on identifying companies with strong fundamentals and holding them through market cycles.

2. Focus on well-run businesses with competitive advantages

"The best companies have some form of intangible assets that work for them."

Seek companies with economic moats. Look for businesses that have sustainable competitive advantages, such as:

- Strong brand recognition

- Proprietary technology or patents

- Network effects

- Economies of scale

- High switching costs for customers

These advantages allow companies to maintain higher profit margins and defend against competition. Examples of companies with strong moats include Coca-Cola (brand), Amazon (scale and network effects), and Disney (intellectual property).

3. Understand the business model and financials before investing

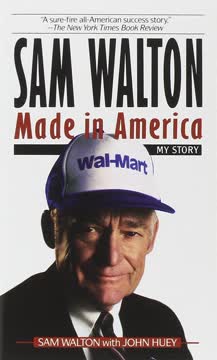

"If you can't explain what Walmart does in 30 words or less, you probably don't understand it well enough."

Do your homework before investing. Thoroughly research a company's:

- Revenue streams and profit drivers

- Competitive landscape

- Management quality and track record

- Financial statements (income statement, balance sheet, cash flow)

- Key performance indicators specific to the industry

Don't invest in businesses you don't understand. Stick to your circle of competence and expand it gradually through continuous learning.

4. Diversification is crucial, but avoid over-diversification

"By owning 20 stocks, your portfolio risk was reduced by an average of 29.2%, when compared to just owning 1."

Balance risk and reward through smart diversification. Aim to hold between 10 and 30 individual stocks across different sectors and market caps. This provides:

- Protection against company-specific risks

- Exposure to various growth opportunities

- Smoother overall portfolio performance

However, avoid over-diversification, which can lead to:

- Diluted returns

- Difficulty in monitoring all positions

- Increased transaction costs

Consider using ETFs or index funds to complement your individual stock holdings and achieve broader market exposure.

5. Valuation matters: Buy great companies at fair prices

"It stands to reason that if you wish to take advantage of these moves, you need to be able to predict the emotions other traders have concerning the stock."

Don't overpay, even for quality companies. Use valuation metrics and tools to determine a fair price for a stock:

- Price-to-Earnings (P/E) ratio

- Price-to-Book (P/B) ratio

- Discounted Cash Flow (DCF) analysis

- Dividend yield (for income-focused investors)

Compare these metrics to industry averages and the company's historical values. Be patient and wait for attractive entry points, such as during market corrections or when a stock is temporarily out of favor.

6. Embrace market volatility as an opportunity

"Flash crashes have become more common these days thanks to the advent of algorithmic trading, a method of automatic trading based on pre-determined variables."

View market downturns as buying opportunities. Instead of panicking during market volatility:

- Maintain a long-term perspective

- Keep cash reserves to take advantage of price drops

- Dollar-cost average into positions over time

- Review your watchlist for attractive entry points

Remember that market volatility is normal and often driven by short-term emotions rather than fundamental changes in company value.

7. Reinvest dividends to harness compound growth

"By choosing the DRIP option, your broker automatically buys the equivalent amount of shares of stock, and your stock holding increases."

Leverage the power of dividend reinvestment. Dividend Reinvestment Plans (DRIPs) offer several advantages:

- Automatic reinvestment of dividends

- Fractional share purchases

- Often commission-free transactions

- Potential discounts on share purchases

By reinvesting dividends, you accelerate portfolio growth through compounding. This strategy works particularly well with dividend growth stocks that consistently increase their payouts over time.

8. Consider ETFs and index funds for passive investing

"Index funds and ETFs follow broad based indices in the market."

Complement individual stocks with passive investments. ETFs and index funds offer:

- Broad market exposure

- Low fees

- Automatic diversification

- Ease of management

These instruments are particularly useful for:

- Core portfolio holdings

- Accessing difficult-to-analyze sectors

- Achieving international diversification

Consider a mix of individual stocks for potential outperformance and ETFs/index funds for stable, market-tracking returns.

9. Develop a rational process for analyzing stocks

"Rational Process Investing system, and you're going to learn exactly why this is."

Create a systematic approach to stock analysis. Develop a checklist or framework that includes:

- Business model analysis

- Competitive landscape assessment

- Management quality evaluation

- Financial statement analysis

- Valuation comparison

Stick to your process to avoid emotional decision-making and ensure consistency in your investment approach. Regularly review and refine your process based on experience and new learning.

10. Continuously educate yourself and stay informed

"As Warren Buffett would say, the best investment you can make is the investment in yourself, and by buying this book, you've done just that."

Never stop learning about investing and finance. To improve your investment skills:

- Read annual reports and financial news

- Study successful investors' strategies and philosophies

- Attend investing seminars or workshops

- Join investment clubs or online communities

- Practice analyzing companies and making mock investments

Remember that investing is a lifelong journey of learning and improvement. Stay curious and open to new ideas while maintaining a critical and rational mindset.

Last updated:

FAQ

What is "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications about?

- Comprehensive Value Investing Guide: The book provides a step-by-step introduction to value investing, focusing on long-term wealth building through buying and holding quality stocks and ETFs.

- Practical Investment Framework: It introduces an 8-step process, including goal setting, rational analysis, and portfolio management, tailored for beginners.

- Stock and ETF Recommendations: The book features a curated list of 20 stocks and ETFs considered the best to buy and hold for the next 20 years.

- Educational Focus: It aims to dispel common investing myths, simplify complex concepts, and empower readers to make independent investment decisions.

Why should I read "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications?

- Beginner-Friendly Approach: The book is designed for those new to investing, breaking down intimidating concepts into easy-to-understand steps.

- Long-Term Wealth Emphasis: It advocates for proven, long-term strategies rather than risky, short-term speculation or day trading.

- Actionable Advice: Readers receive practical tools, such as a free valuation spreadsheet and specific stock recommendations, to apply the lessons immediately.

- Myth-Busting Content: The book challenges popular misconceptions about investing, helping readers avoid common pitfalls and emotional mistakes.

What are the key takeaways from "The 8-Step Beginner’s Guide to Value Investing"?

- Buy and Hold Wins: Long-term, buy-and-hold investing outperforms short-term trading and speculation for most investors.

- Rational Process Investing: Success comes from a repeatable, rational process focused on business fundamentals, not market noise or trends.

- Diversification Matters: Proper diversification (10-30 stocks) reduces risk without overwhelming the investor.

- Emotional Discipline: Mastering emotions and avoiding reactionary decisions is crucial for investment success.

What is the 8-step process for value investing recommended in "The 8-Step Beginner’s Guide to Value Investing"?

- 1. Long-Term Outlook: Adopt a buy-and-hold philosophy, focusing on multi-year horizons rather than short-term gains.

- 2. Define Investing Goals: Set clear, realistic financial goals and ensure you have a stable financial base before investing.

- 3. Understand Benefits: Recognize the tax, emotional, and compounding advantages of long-term investing.

- 4. Rational Analysis: Use a systematic approach to analyze companies, focusing on business quality and management.

- 5. Ignore Distractions: Learn what factors (like media hype, analyst consensus, and isolated numbers) do not matter in stock analysis.

- 6. Stock Selection: Apply the process to select 20 high-quality companies or ETFs to buy and hold.

- 7. Valuation: Use simple, key metrics to determine a fair price for each investment.

- 8. Efficient Buying: Choose between lump-sum investing and dollar-cost averaging, and use dividend reinvestment plans for compounding.

What is "Rational Process Investing" as described in "The 8-Step Beginner’s Guide to Value Investing"?

- Business-First Focus: Prioritize understanding the underlying business, its management, and its competitive advantages over technical analysis or market sentiment.

- Warren Buffett Test: Invest in companies you can explain simply, with honest, competent management and a clear economic moat.

- Intangible Assets Matter: Look for companies with strong brands, intellectual property, or network effects that provide lasting advantages.

- Long-Term Resilience: Favor businesses that can weather economic storms and adapt to changing environments.

How does "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications recommend analyzing and valuing stocks?

- Key Metrics: Focus on earnings per share (EPS), price-to-earnings (PE) ratio, 10-year equity growth rate, minimum acceptable rate of return, and margin of safety.

- Intrinsic Value: Calculate a fair price based on projected growth and desired returns, ensuring a margin of safety to protect against errors.

- Contextual Analysis: Always compare financial numbers within industry context and against competitors, not in isolation.

- Free Tools Provided: The book offers a free valuation spreadsheet and video course to help readers apply these methods.

What are the 20 best stocks and ETFs to buy and hold for the next 20 years according to "The 8-Step Beginner’s Guide to Value Investing"?

- Diverse Selection: The list includes companies like Disney, Amazon, McDonald's, Walmart, Coca-Cola, Starbucks, PayPal, and ETFs such as Crown Castle International and Innovative Industrial Properties.

- Sector Coverage: Recommendations span technology, consumer goods, healthcare, real estate, and financial services.

- Rationale Provided: Each pick is justified based on business model strength, management quality, economic moat, and long-term growth prospects.

- Not Just Big Names: The list also features lesser-known but high-potential companies like Sandstorm Gold, The Trade Desk, and Zuora.

What are the main benefits of long-term investing highlighted in "The 8-Step Beginner’s Guide to Value Investing"?

- Tax Efficiency: Lower capital gains taxes and greater compounding by minimizing frequent trading.

- Emotional Stability: Reduces stress and emotional decision-making by focusing on long-term outcomes.

- Passive Income: Enables accumulation of dividends and reinvestment for greater returns.

- No Need to Time the Market: Entry price matters less over decades, and there’s no pressure to chase “unicorn” stocks.

What does "The 8-Step Beginner’s Guide to Value Investing" say about diversification and portfolio management?

- Optimal Diversification: Holding 10-30 stocks balances risk reduction with manageability; owning more offers diminishing returns.

- Avoid Diworsification: Don’t over-concentrate in one sector or own too many tiny positions you can’t track.

- Supplement with Funds: Use index funds or ETFs for additional diversification, especially if you lack expertise in certain sectors.

- Regular Review: Monitor your holdings for changes in business fundamentals, not just price movements.

How does "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications address emotional investing and market psychology?

- Emotions Drive Short-Term Prices: The book explains how fear, greed, and herd mentality cause market volatility and poor decisions.

- Unrealized vs. Realized Losses: Emphasizes that losses are only real when you sell; patience is key.

- Ignore Market Noise: Advises tuning out media hype, analyst ratings, and consensus opinions that can lead to reactionary moves.

- Personal Finance Foundation: Stresses the importance of only investing money you won’t need for at least 10 years to avoid panic selling.

What are the recommended strategies for buying stocks in "The 8-Step Beginner’s Guide to Value Investing"?

- Lump-Sum Investing Preferred: Investing all available funds at once generally outperforms dollar-cost averaging over the long term.

- Dollar-Cost Averaging Use: Suitable if you receive regular income to invest, but not for holding cash on the sidelines.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends to buy more shares, compounding returns without extra fees.

- Minimize Transaction Costs: Use low-commission or commission-free brokers to maximize investment efficiency.

What are the best quotes from "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications and what do they mean?

- Peter Lynch on Small Investors: “I think it's a tragedy that the small investor has been convinced by the media that they don't have a chance...if someone can sit back, and form their own opinion about a company or an industry, I think the public can do extremely well in the stock market on their own.” — Encourages individual investors to trust their own research and judgment.

- Warren Buffett’s Wisdom: “The best investment you can make is the investment in yourself.” — Highlights the importance of education and self-improvement in investing.

- On Market Madness: “I could calculate the motions of the heavenly bodies, but not the madness of the people.” — Isaac Newton’s quote, used to illustrate the unpredictability of market psychology.

- On Long-Term Focus: “In the short term the market is a voting machine but in the long term, it’s a weighing machine.” — Benjamin Graham’s classic reminder that fundamentals win over time.

- On Emotional Discipline: “Emotions are not facts.” — A core theme throughout the book, reminding readers to separate feelings from investment decisions.

Review Summary

The 8-Step Beginner's Guide to Value Investing receives mostly positive reviews, with readers praising its practical advice and easy-to-understand approach to long-term value investing. Many find it helpful for beginners, appreciating its insights on stock analysis and company evaluation. Some readers note its emphasis on holding stocks for extended periods and its list of recommended long-term investments. However, a few critics mention spelling errors and suggest that the book may be too basic for experienced investors.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.