Key Takeaways

1. Enron's Culture of Aggressive Financial Manipulation

"It started out as pure, clear, legitimate deals, and each deal gets a little bit messier and messier. We started out just taking one hit of cocaine, and the next thing you know, we're importing the stuff from Colombia."

The Gradual Descent into Fraud. Enron's downfall wasn't a sudden event but a slow erosion of ethical boundaries. The company's culture systematically pushed the limits of acceptable business practices, with each compromise making the next one easier.

The financial manipulation began incrementally, with seemingly minor accounting adjustments that grew progressively more complex and deceptive. Key characteristics included:

- Constantly pushing accounting rule boundaries

- Creating increasingly complex financial structures

- Prioritizing appearances over actual financial performance

- Developing a culture that rewarded creative financial reporting

Normalization of Deception. What started as minor financial engineering gradually transformed into outright fraud, with executives convincing themselves that their actions were innovative rather than unethical. The company's internal culture celebrated those who could find creative ways to meet financial targets, regardless of the underlying economic reality.

2. The Illusion of Innovation and Growth

"We were doing something special. Magical. We were changing the world. We were doing God's work."

False Narrative of Transformation. Enron marketed itself as a revolutionary company that was reimagining the energy industry, when in reality, it was primarily engaged in financial manipulation and speculative trading.

Key aspects of Enron's illusive innovation included:

- Creating complex financial structures that appeared to generate value

- Developing businesses with no substantive economic foundation

- Using mark-to-market accounting to create phantom profits

- Presenting speculative ventures as groundbreaking achievements

The Myth of Reinvention. The company's leadership, particularly Jeff Skilling, believed they were creating something unprecedented, when they were actually building a house of cards designed to impress Wall Street and maintain an unsustainable stock price.

3. Leadership's Role in Ethical Breakdown

"Ken Lay had a lack of understanding of just how much Kinder did. He felt anybody he selected could run that company the same way Rich did."

Failure of Corporate Governance. Enron's leadership, particularly Ken Lay and Jeff Skilling, created a culture that prioritized appearance over substance, actively encouraging aggressive and unethical business practices.

Critical leadership failures included:

- Lack of rigorous financial oversight

- Rewarding short-term financial engineering

- Creating a culture of fear and competitive manipulation

- Disconnecting from the practical realities of the business

Systemic Leadership Dysfunction. The top executives were more concerned with maintaining their public image and stock price than with building a sustainable, ethical business model.

4. The Danger of Unchecked Ambition

"If you're the CEO of a public company, it isn't yours. But Lay seemed oblivious of such distinctions."

Hubris and Entitlement. Enron's leaders developed an overwhelming sense of personal entitlement, treating the company as their personal playground rather than a responsibility to shareholders and employees.

Manifestations of unchecked ambition included:

- Excessive personal use of corporate resources

- Nepotism and favoritism

- Disregard for traditional business constraints

- Belief in personal infallibility

The Corruption of Success. The more successful Enron became, the more its leaders believed they were above normal business rules and ethical considerations.

5. Wall Street's Complicity in Corporate Fraud

"They'd beat the crap out of the lawyers, they'd beat the crap out of the investment bankers, they'd beat the shit out of the accountants."

Systemic Financial Ecosystem Failure. Wall Street banks, analysts, and financial institutions actively enabled and profited from Enron's fraudulent practices.

Key elements of complicity:

- Prioritizing fees over ethical considerations

- Willful ignorance of obvious financial irregularities

- Creating complex financial structures to hide risk

- Rewarding short-term financial engineering

Collective Moral Compromise. The financial industry's culture of aggressive deal-making created an environment where ethical boundaries were consistently overlooked in pursuit of profit.

6. Accounting Tricks and Financial Engineering

"Say you have a dog, but you need to create a duck on the financial statements. Fortunately, there are specific accounting rules for what constitutes a duck."

Creative Accounting Manipulation. Enron developed intricate methods of manipulating financial reporting to create an illusion of profitability and growth.

Primary accounting strategies included:

- Mark-to-market accounting abuse

- Off-balance-sheet partnerships

- Complex financial derivative structures

- Strategic earnings management

Exploiting Accounting Ambiguity. The company's financial team became experts at finding loopholes and interpreting accounting rules in ways that technically complied with regulations while fundamentally misrepresenting the company's financial health.

7. The Collapse of Corporate Integrity

"Corporate management's performance is generally measured by accounting income, not underlying economics."

Prioritizing Perception Over Reality. Enron systematically destroyed its own integrity by consistently choosing short-term appearances over long-term sustainability.

Indicators of integrity collapse:

- Consistent misrepresentation of financial performance

- Creating fictional business units

- Rewarding deceptive behavior

- Punishing internal critics

Cultural Decay. The company's ethical breakdown was not a sudden event but a gradual process of moral erosion, where each compromise made the next one easier.

8. Systemic Failures in Business Oversight

"One of the most important lessons from litigation involving our profession is that client selection and retention are among the most important factors in determining our risk exposure."

Breakdown of Institutional Safeguards. Multiple layers of oversight—including accounting firms, boards of directors, and regulatory bodies—failed to prevent Enron's fraudulent practices.

Systemic failure points:

- Auditors compromising independence

- Board members lacking critical oversight

- Regulators failing to enforce existing rules

- Analysts promoting uncritical narratives

Institutional Complicity. The very institutions designed to protect investors and maintain market integrity became enablers of corporate malfeasance.

9. The Human Cost of Corporate Greed

"People would say to me: 'Hey, it's not your problem.' 'You're not going to be around. Why do you care?' "

Personal Moral Disengagement. Enron's culture encouraged individual employees to disconnect from the broader consequences of their actions.

Human impacts included:

- Massive job losses

- Destruction of employee retirement savings

- Psychological trauma for workers

- Erosion of trust in corporate institutions

Individual Responsibility. The story reveals how ordinary people can become complicit in extraordinary wrongdoing when organizational culture normalizes unethical behavior.

10. Lessons in Corporate Governance and Ethics

"If shareholders understood the extent to which the future was being mortgaged..."

Critical Governance Principles. Enron's collapse provides a blueprint for understanding essential elements of ethical corporate management.

Key lessons:

- Prioritize long-term sustainability over short-term gains

- Maintain robust, independent oversight

- Create cultures that reward ethical behavior

- Implement transparent financial reporting

- Develop strong internal control mechanisms

Institutional Learning. The Enron scandal serves as a critical case study in the importance of maintaining ethical standards and implementing rigorous corporate governance.

Last updated:

FAQ

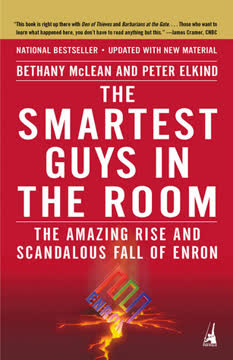

What's The Smartest Guys in the Room about?

- Enron's Transformation: The book details Enron's evolution from a natural gas pipeline operator to a major player in energy trading and broadband, and its eventual collapse due to unethical practices.

- Corporate Culture: It examines the toxic corporate culture at Enron, characterized by greed, ambition, and ethical lapses, which played a significant role in the company's downfall.

- Key Figures: The narrative focuses on key executives like Ken Lay, Jeff Skilling, and Andrew Fastow, exploring their roles in the scandal and how their decisions impacted the company.

Why should I read The Smartest Guys in the Room?

- Insight into Corporate Scandals: The book provides a detailed account of one of the largest corporate frauds in history, offering lessons on ethics and corporate governance.

- Engaging Storytelling: Authors Bethany McLean and Peter Elkind use investigative journalism and storytelling to make complex financial concepts accessible and engaging.

- Relevance to Current Events: The themes of greed and corruption are still relevant today, making it a timely read for those interested in business ethics and corporate governance.

What are the key takeaways of The Smartest Guys in the Room?

- Consequences of Greed: The book illustrates how unchecked ambition and greed can lead to catastrophic outcomes for individuals and society.

- Importance of Transparency: It emphasizes the need for transparency and accountability in corporate governance to prevent fraud and maintain investor trust.

- Role of Leadership: The narrative highlights the critical role of ethical leadership in shaping corporate culture and decision-making.

What are the best quotes from The Smartest Guys in the Room and what do they mean?

- “I don’t care what you say about Enron. Just don’t make me look bad.”: This quote from CFO Andrew Fastow encapsulates the culture of denial and self-preservation at Enron.

- “We were the apostles.”: Reflects the zealous belief among Enron's traders that they were revolutionizing the energy industry, showcasing their hubris.

- “Shit happens.”: Skilling's remark about business failures illustrates his lack of accountability and the cavalier attitude that contributed to Enron's ethical lapses.

How did Enron manipulate its financial statements?

- Mark-to-Market Accounting: Enron used this method to book projected profits as current income, creating a misleading picture of financial health.

- Special-Purpose Entities: These were used to hide debt and inflate profits, keeping liabilities off the balance sheet and misleading investors.

- Complex Financial Structures: Enron's intricate financial arrangements obscured its actual performance, making it difficult for analysts to understand the company's true state.

What role did Andrew Fastow play in Enron's downfall?

- Chief Financial Officer: Fastow was instrumental in creating complex financial structures that allowed Enron to hide debt and inflate profits.

- LJM Partnerships: He established these partnerships to profit personally while facilitating Enron's financial manipulations.

- Risky Financial Practices: Fastow's aggressive use of off-balance-sheet financing contributed to Enron's precarious financial situation.

How did the corporate culture at Enron contribute to its collapse?

- Risk-Taking Environment: Enron's culture celebrated risk-taking and innovation, often at the expense of ethical considerations.

- Pressure to Perform: Executives faced immense pressure to meet Wall Street's expectations, leading to unethical practices.

- Lack of Accountability: The absence of effective oversight allowed unethical behavior to flourish, with executives operating with impunity.

What were the consequences of Enron's collapse?

- Financial Ruin for Employees: Thousands lost their jobs and retirement savings, devastating the lives of many who had invested their futures in the company.

- Regulatory Changes: The scandal prompted major reforms, including the Sarbanes-Oxley Act, aimed at improving corporate governance and accountability.

- Loss of Trust: Enron's downfall eroded public trust in corporate America and the accounting profession, highlighting the need for greater transparency.

How did Enron manipulate the California energy market?

- Exploiting Regulatory Loopholes: Enron traders identified and exploited weaknesses in California's deregulation rules to manipulate prices.

- Creating Artificial Scarcity: By withholding power and creating the illusion of scarcity, Enron drove prices up significantly.

- Using Complex Strategies: Tactics like "Fat Boy" and "Death Star" were employed to game the system and generate profits.

What specific methods did Enron use to manipulate its financial statements?

- Mark-to-Market Accounting: Allowed Enron to record projected profits as current income, inflating its financial health.

- Special Purpose Entities (SPEs): Used to hide debt and inflate profits, keeping liabilities off the balance sheet.

- Complex Financial Structures: Obscured actual performance, making it difficult for analysts to understand the company's true state.

How did the Enron scandal affect the financial industry?

- Loss of Investor Confidence: The scandal eroded trust in corporate governance and financial reporting, leading to a decline in investor confidence.

- Regulatory Reforms: The Sarbanes-Oxley Act was enacted to enhance corporate accountability and transparency.

- Increased Scrutiny of Auditors: The role of auditors in corporate governance was reevaluated, with greater pressure to maintain independence.

What lessons can be learned from The Smartest Guys in the Room?

- Ethical Leadership is Crucial: The book underscores the importance of ethical leadership and the need for executives to model integrity.

- Transparency in Financial Reporting: Highlights the necessity for clear and honest financial reporting practices to maintain trust.

- Caution Against Hubris: Serves as a reminder of the dangers of hubris and the belief that one can outsmart the system without consequences.

Review Summary

The Smartest Guys in the Room is a comprehensive account of Enron's rise and fall, detailing the company's complex financial practices and corporate culture. Readers praise the book's thorough research and compelling narrative, though some find it dense with financial jargon. The authors effectively portray key figures like Ken Lay and Jeff Skilling, revealing their ambition and hubris. While the book can be challenging to follow at times, it offers valuable insights into corporate fraud and the dangers of unchecked capitalism. Many reviewers consider it a must-read for those interested in business ethics and financial history.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.