重点摘要

1. 长期投资优于短期交易

“普通散户投资者购买个股的年均回报率仅为2.1%。”

市场时间不如市场时间长。 长期投资可以让你受益于复利增长,并减少短期市场波动的影响。通过长期持有优质股票,你可以:

- 最小化交易成本和税收

- 受益于时间推移中的股息增长

- 允许公司执行其长期战略

避免因市场情绪或短期新闻而频繁买卖的诱惑。相反,专注于识别具有强大基本面的公司,并在市场周期中持有它们。

2. 专注于具有竞争优势的优秀企业

“最好的公司拥有某种形式的无形资产为其服务。”

寻找具有经济护城河的公司。 寻找那些拥有可持续竞争优势的企业,例如:

- 强大的品牌认知度

- 专有技术或专利

- 网络效应

- 规模经济

- 高客户转换成本

这些优势使公司能够维持较高的利润率并抵御竞争。具有强大护城河的公司例子包括可口可乐(品牌)、亚马逊(规模和网络效应)和迪士尼(知识产权)。

3. 在投资前了解商业模式和财务状况

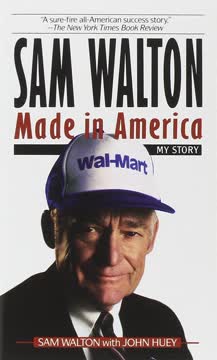

“如果你不能用30个字或更少解释沃尔玛的业务,你可能对它了解得不够。”

在投资前做好功课。 彻底研究一家公司的:

- 收入来源和利润驱动因素

- 竞争格局

- 管理质量和业绩记录

- 财务报表(损益表、资产负债表、现金流量表)

- 行业特定的关键绩效指标

不要投资于你不了解的业务。坚持你的能力圈,并通过持续学习逐步扩大它。

4. 多元化至关重要,但避免过度多元化

“持有20只股票时,与仅持有1只股票相比,投资组合风险平均降低了29.2%。”

通过聪明的多元化平衡风险和回报。 目标是持有10到30只不同部门和市值的个股。这提供了:

- 防范公司特定风险

- 接触各种增长机会

- 更平稳的整体投资组合表现

然而,避免过度多元化,这可能导致:

- 回报稀释

- 难以监控所有头寸

- 增加交易成本

考虑使用ETF或指数基金来补充你的个股持仓,并实现更广泛的市场曝光。

5. 估值很重要:以合理价格购买优秀公司

“如果你想利用这些波动,你需要能够预测其他交易者对股票的情绪。”

即使是优质公司也不要支付过高的价格。 使用估值指标和工具来确定股票的合理价格:

- 市盈率(P/E)

- 市净率(P/B)

- 折现现金流(DCF)分析

- 股息收益率(针对收入导向的投资者)

将这些指标与行业平均水平和公司的历史价值进行比较。耐心等待有吸引力的入场点,例如在市场调整期间或股票暂时不受欢迎时。

6. 将市场波动视为机会

“由于算法交易的出现,闪电崩盘如今变得更加常见,这是一种基于预定变量的自动交易方法。”

将市场下跌视为买入机会。 在市场波动期间不要恐慌:

- 保持长期视角

- 保持现金储备以利用价格下跌

- 随时间推移平均成本进入头寸

- 查看你的观察名单以寻找有吸引力的入场点

记住,市场波动是正常的,通常由短期情绪而非公司价值的基本变化驱动。

7. 通过再投资股息来利用复利增长

“选择DRIP选项时,你的经纪人会自动购买相当数量的股票,你的股票持有量增加。”

利用股息再投资的力量。 股息再投资计划(DRIPs)提供了几个优势:

- 自动再投资股息

- 部分股票购买

- 通常免佣金交易

- 购买股票时可能有折扣

通过再投资股息,你可以通过复利加速投资组合增长。这一策略在股息增长股票中效果尤为显著,这些股票会随着时间的推移不断增加派息。

8. 考虑ETF和指数基金进行被动投资

“指数基金和ETF跟踪市场中的广泛指数。”

用被动投资补充个股。 ETF和指数基金提供:

- 广泛的市场曝光

- 低费用

- 自动多元化

- 易于管理

这些工具特别适用于:

- 核心投资组合持仓

- 进入难以分析的行业

- 实现国际多元化

考虑将个股与ETF/指数基金混合,以实现潜在的超额收益和稳定的市场跟踪回报。

9. 为分析股票制定理性流程

“理性流程投资系统,你将了解其中的原因。”

创建系统化的股票分析方法。 制定一个包含以下内容的清单或框架:

- 商业模式分析

- 竞争格局评估

- 管理质量评估

- 财务报表分析

- 估值比较

坚持你的流程,以避免情绪化决策,并确保投资方法的一致性。根据经验和新学习定期审查和完善你的流程。

10. 不断自我教育并保持信息更新

“正如沃伦·巴菲特所说,你能做的最好的投资就是对自己的投资,而购买这本书就是这样做的。”

永远不要停止学习投资和金融。 为了提高你的投资技能:

- 阅读年度报告和金融新闻

- 研究成功投资者的策略和理念

- 参加投资研讨会或工作坊

- 加入投资俱乐部或在线社区

- 练习分析公司并进行模拟投资

记住,投资是一场终身学习和改进的旅程。保持好奇心并开放接受新想法,同时保持批判性和理性的思维方式。

最后更新日期:

FAQ

What is "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications about?

- Comprehensive Value Investing Guide: The book provides a step-by-step introduction to value investing, focusing on long-term wealth building through buying and holding quality stocks and ETFs.

- Practical Investment Framework: It introduces an 8-step process, including goal setting, rational analysis, and portfolio management, tailored for beginners.

- Stock and ETF Recommendations: The book features a curated list of 20 stocks and ETFs considered the best to buy and hold for the next 20 years.

- Educational Focus: It aims to dispel common investing myths, simplify complex concepts, and empower readers to make independent investment decisions.

Why should I read "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications?

- Beginner-Friendly Approach: The book is designed for those new to investing, breaking down intimidating concepts into easy-to-understand steps.

- Long-Term Wealth Emphasis: It advocates for proven, long-term strategies rather than risky, short-term speculation or day trading.

- Actionable Advice: Readers receive practical tools, such as a free valuation spreadsheet and specific stock recommendations, to apply the lessons immediately.

- Myth-Busting Content: The book challenges popular misconceptions about investing, helping readers avoid common pitfalls and emotional mistakes.

What are the key takeaways from "The 8-Step Beginner’s Guide to Value Investing"?

- Buy and Hold Wins: Long-term, buy-and-hold investing outperforms short-term trading and speculation for most investors.

- Rational Process Investing: Success comes from a repeatable, rational process focused on business fundamentals, not market noise or trends.

- Diversification Matters: Proper diversification (10-30 stocks) reduces risk without overwhelming the investor.

- Emotional Discipline: Mastering emotions and avoiding reactionary decisions is crucial for investment success.

What is the 8-step process for value investing recommended in "The 8-Step Beginner’s Guide to Value Investing"?

- 1. Long-Term Outlook: Adopt a buy-and-hold philosophy, focusing on multi-year horizons rather than short-term gains.

- 2. Define Investing Goals: Set clear, realistic financial goals and ensure you have a stable financial base before investing.

- 3. Understand Benefits: Recognize the tax, emotional, and compounding advantages of long-term investing.

- 4. Rational Analysis: Use a systematic approach to analyze companies, focusing on business quality and management.

- 5. Ignore Distractions: Learn what factors (like media hype, analyst consensus, and isolated numbers) do not matter in stock analysis.

- 6. Stock Selection: Apply the process to select 20 high-quality companies or ETFs to buy and hold.

- 7. Valuation: Use simple, key metrics to determine a fair price for each investment.

- 8. Efficient Buying: Choose between lump-sum investing and dollar-cost averaging, and use dividend reinvestment plans for compounding.

What is "Rational Process Investing" as described in "The 8-Step Beginner’s Guide to Value Investing"?

- Business-First Focus: Prioritize understanding the underlying business, its management, and its competitive advantages over technical analysis or market sentiment.

- Warren Buffett Test: Invest in companies you can explain simply, with honest, competent management and a clear economic moat.

- Intangible Assets Matter: Look for companies with strong brands, intellectual property, or network effects that provide lasting advantages.

- Long-Term Resilience: Favor businesses that can weather economic storms and adapt to changing environments.

How does "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications recommend analyzing and valuing stocks?

- Key Metrics: Focus on earnings per share (EPS), price-to-earnings (PE) ratio, 10-year equity growth rate, minimum acceptable rate of return, and margin of safety.

- Intrinsic Value: Calculate a fair price based on projected growth and desired returns, ensuring a margin of safety to protect against errors.

- Contextual Analysis: Always compare financial numbers within industry context and against competitors, not in isolation.

- Free Tools Provided: The book offers a free valuation spreadsheet and video course to help readers apply these methods.

What are the 20 best stocks and ETFs to buy and hold for the next 20 years according to "The 8-Step Beginner’s Guide to Value Investing"?

- Diverse Selection: The list includes companies like Disney, Amazon, McDonald's, Walmart, Coca-Cola, Starbucks, PayPal, and ETFs such as Crown Castle International and Innovative Industrial Properties.

- Sector Coverage: Recommendations span technology, consumer goods, healthcare, real estate, and financial services.

- Rationale Provided: Each pick is justified based on business model strength, management quality, economic moat, and long-term growth prospects.

- Not Just Big Names: The list also features lesser-known but high-potential companies like Sandstorm Gold, The Trade Desk, and Zuora.

What are the main benefits of long-term investing highlighted in "The 8-Step Beginner’s Guide to Value Investing"?

- Tax Efficiency: Lower capital gains taxes and greater compounding by minimizing frequent trading.

- Emotional Stability: Reduces stress and emotional decision-making by focusing on long-term outcomes.

- Passive Income: Enables accumulation of dividends and reinvestment for greater returns.

- No Need to Time the Market: Entry price matters less over decades, and there’s no pressure to chase “unicorn” stocks.

What does "The 8-Step Beginner’s Guide to Value Investing" say about diversification and portfolio management?

- Optimal Diversification: Holding 10-30 stocks balances risk reduction with manageability; owning more offers diminishing returns.

- Avoid Diworsification: Don’t over-concentrate in one sector or own too many tiny positions you can’t track.

- Supplement with Funds: Use index funds or ETFs for additional diversification, especially if you lack expertise in certain sectors.

- Regular Review: Monitor your holdings for changes in business fundamentals, not just price movements.

How does "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications address emotional investing and market psychology?

- Emotions Drive Short-Term Prices: The book explains how fear, greed, and herd mentality cause market volatility and poor decisions.

- Unrealized vs. Realized Losses: Emphasizes that losses are only real when you sell; patience is key.

- Ignore Market Noise: Advises tuning out media hype, analyst ratings, and consensus opinions that can lead to reactionary moves.

- Personal Finance Foundation: Stresses the importance of only investing money you won’t need for at least 10 years to avoid panic selling.

What are the recommended strategies for buying stocks in "The 8-Step Beginner’s Guide to Value Investing"?

- Lump-Sum Investing Preferred: Investing all available funds at once generally outperforms dollar-cost averaging over the long term.

- Dollar-Cost Averaging Use: Suitable if you receive regular income to invest, but not for holding cash on the sidelines.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends to buy more shares, compounding returns without extra fees.

- Minimize Transaction Costs: Use low-commission or commission-free brokers to maximize investment efficiency.

What are the best quotes from "The 8-Step Beginner’s Guide to Value Investing" by Freeman Publications and what do they mean?

- Peter Lynch on Small Investors: “I think it's a tragedy that the small investor has been convinced by the media that they don't have a chance...if someone can sit back, and form their own opinion about a company or an industry, I think the public can do extremely well in the stock market on their own.” — Encourages individual investors to trust their own research and judgment.

- Warren Buffett’s Wisdom: “The best investment you can make is the investment in yourself.” — Highlights the importance of education and self-improvement in investing.

- On Market Madness: “I could calculate the motions of the heavenly bodies, but not the madness of the people.” — Isaac Newton’s quote, used to illustrate the unpredictability of market psychology.

- On Long-Term Focus: “In the short term the market is a voting machine but in the long term, it’s a weighing machine.” — Benjamin Graham’s classic reminder that fundamentals win over time.

- On Emotional Discipline: “Emotions are not facts.” — A core theme throughout the book, reminding readers to separate feelings from investment decisions.

评论

《8步初学者价值投资指南》大多获得积极评价,读者称赞其实用建议和易于理解的长期价值投资方法。许多人认为这对初学者很有帮助,欣赏其对股票分析和公司评估的见解。一些读者注意到书中强调长期持有股票,并提供了推荐的长期投资清单。然而,少数批评者提到拼写错误,并建议该书对有经验的投资者来说可能过于基础。

Similar Books