Key Takeaways

1. Swing Trading: Short-Term Gains, Strategic Moves

Swing trading is the art and science of profiting from securities’ short-term price movements spanning a few days to a few weeks — one or two months, max.

Not buy-and-hold, not day trading. Swing trading occupies a middle ground, holding positions for days or weeks, unlike long-term investing or day trading. It aims to capture short-term price swings, requiring a different approach than either of those strategies.

Time commitment varies. Swing trading can be a full-time job, a part-time income supplement, or even a hobby. The time commitment you make will influence your trading style and strategy. Full-time traders can monitor the market throughout the day, while part-time traders must rely on orders placed outside market hours.

Strategic planning is key. A successful swing trader needs a well-defined plan that outlines which securities to trade, where to trade them, and when to enter and exit positions. This plan should also include risk management strategies to protect capital.

2. Technical Analysis: Charts, Trends, and Timing

Technical analysis is the art of reading a security price chart with volume and determining the security’s likely direction based on the strength of buyers and sellers.

Price and volume are key. Technical analysis focuses on price charts and volume to identify patterns and trends. It assumes that all available information is reflected in the price and that market participants react similarly to news.

Chart patterns reveal psychology. Swing traders use various chart patterns, such as head and shoulders, cup and handle, and triangles, to assess market psychology and predict future price movements. Candlestick charts offer additional insights into price action.

Technical indicators provide signals. Technical indicators, like moving averages, MACD, RSI, and stochastics, are mathematical formulas applied to price and volume data to generate buy and sell signals. These indicators help traders identify trends and momentum.

3. Fundamental Analysis: Value, Growth, and Catalysts

Fundamental analysis can answer questions that are beyond the scope of technical analysis, such as, “Why is this security price moving?”

Beyond the charts. Fundamental analysis examines a company's financial health, including its earnings, sales, and cash flow. It seeks to understand the underlying reasons for price movements, not just the movements themselves.

Catalysts drive short-term moves. Swing traders use catalysts, such as earnings releases, new products, or acquisitions, to identify short-term trading opportunities. These events can cause significant price changes.

Growth vs. value. Fundamental analysis also involves classifying companies as either growth or value stocks. Growth stocks are expected to grow rapidly, while value stocks are considered undervalued. Knowing which style is in favor can improve your trading results.

4. Brokerage and Tools: Setting Up for Success

You must rely on yourself and can’t be reckless or prone to gambling.

Choosing the right broker. Swing traders need a broker that offers low commissions, a user-friendly trading platform, and access to the markets they want to trade. Discount brokers and direct access firms are often the best options.

Essential service providers. Swing traders need access to charting software, real-time quotes, and fundamental data. Many free and paid services are available, but it's important to choose providers that offer reliable and timely information.

The importance of a trading journal. A trading journal is a crucial tool for tracking trades, analyzing performance, and identifying areas for improvement. It should include details about each trade, including entry and exit points, reasons for the trade, and the outcome.

5. Risk Management: Protecting Your Capital

The most important chapter in Swing Trading For Dummies is Chapter 10, where I explain how to manage your portfolio’s risk.

Risk management is paramount. Risk management is the most important aspect of swing trading. It involves limiting losses at both the individual stock level and the portfolio level.

Position sizing is key. Position sizing involves determining how much capital to allocate to each trade. This should be based on your risk tolerance and the volatility of the security.

Stop loss orders are essential. Stop loss orders are a crucial tool for limiting losses. They automatically exit a position when the price reaches a predefined level.

6. Order Types: Precision in Execution

Plan your trade and trade your plan.

Market orders for speed. Market orders are used to buy or sell a security immediately at the best available price. They are useful when speed is essential, but they can result in less favorable prices.

Limit orders for control. Limit orders allow you to buy or sell a security at a specific price or better. They provide more control over execution prices but may not always be filled.

Stop orders for protection. Stop orders are used to buy or sell a security when the price reaches a predefined level. They are useful for limiting losses or entering a position when a specific price is reached.

7. Putting It All Together: A Swing Trade in Action

Plan your trade and trade your plan.

Market analysis first. Before entering a trade, assess the overall market trend using daily and weekly charts. Determine whether the market is trending up, down, or sideways.

Identify leading industries. Focus on industry groups that are outperforming the market. This increases the likelihood that your trades will be profitable.

Select promising candidates. Use fundamental screens to filter securities within leading industry groups. Then, use technical analysis to identify entry points.

Manage risk and execute. Determine your position size based on your risk tolerance and set stop loss orders to protect your capital. Execute your trades and record them in your trading journal.

8. Performance Evaluation: Measuring Your Progress

If you don’t properly calculate your returns, you’ll never know whether you’re doing any better than the overall market.

Simple returns are not enough. Calculating simple returns is easy, but it doesn't account for the effects of deposits and withdrawals. Time-weighted returns are a more accurate measure of performance.

Annualizing returns for comparison. Annualizing returns allows you to compare returns over different time periods. This is essential for evaluating your performance against benchmarks.

Benchmarking your results. Compare your returns to appropriate benchmarks, such as the S&P 500 Index or other relevant indexes. This helps you determine whether you're outperforming or underperforming the market.

9. Swing Trading Do's: Ten Rules to Live By

Trade Your Plan.

Ten simple rules for swing trading:

- Trade your plan

- Follow the lead of industry groups and the overall market

- Don't let emotions control your trading

- Diversify your holdings

- Set your risk level

- Set a profit target or technical exit

- Use limit orders

- Use stop loss orders

- Keep a trading journal

- Have fun!

These rules provide a framework for successful swing trading. They emphasize the importance of planning, discipline, and emotional control.

10. Swing Trading Don'ts: Ten Sins to Avoid

Starting with Too Little Capital.

Ten deadly sins of swing trading:

- Starting with too little capital

- Gambling on earnings dates

- Speculating on penny stocks

- Changing your trading destination midflight

- Doubling down

- Swing trading option securities

- Thinking you're hot stuff

- Concentrating on a single sector

- Overtrading

- Violating your trading plan

These sins highlight common mistakes that can lead to subpar performance. They emphasize the importance of avoiding risky behaviors and sticking to your trading plan.

Last updated:

FAQ

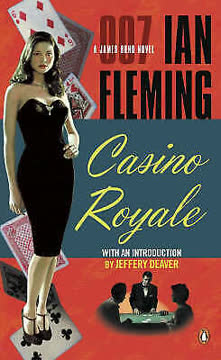

What's Swing Trading for Dummies about?

- Focus on Swing Trading: Swing Trading for Dummies by Omar Bassal is a guide to swing trading, a strategy aimed at capturing short-term price movements in securities.

- Comprehensive Coverage: It covers both technical and fundamental analysis, emphasizing money management, journal keeping, and strategy planning.

- Practical Guidance: The book offers actionable advice for traders of all levels, helping them navigate market complexities effectively.

Why should I read Swing Trading for Dummies?

- Beginner-Friendly: Designed for those with little to no experience, making it an excellent starting point for stock market enthusiasts.

- Expert Insights: Written by seasoned investment professional Omar Bassal, offering real-world experience and proven strategies.

- Holistic Approach: Emphasizes trading techniques, psychological aspects, and risk management for long-term success.

What are the key takeaways of Swing Trading for Dummies?

- Market Dynamics: Learn to analyze market trends and identify trading opportunities through technical and fundamental analysis.

- Risk Management: Focus on managing risk, with the book stating that effective risk management can lead to profitability even with poor decisions.

- Trading Plan Development: Stresses the necessity of a well-defined trading plan, including entry and exit strategies.

What are the best quotes from Swing Trading for Dummies and what do they mean?

- "Plan your trade and trade your plan.": Highlights the importance of a structured approach to prevent emotional decision-making.

- "Swing trading isn’t going to lead to overnight wealth.": Serves as a reality check, emphasizing patience and discipline over get-rich-quick schemes.

- "Many hands make light work.": Suggests the value of collaboration and learning from others in the trading community.

What is swing trading, as defined in Swing Trading for Dummies?

- Short-Term Strategy: Described as profiting from short-term price movements, typically holding securities for a few days to weeks.

- Market Timing: Aims to capitalize on price swings by entering low-risk opportunities and exiting at favorable levels.

- Comparison to Day Trading: Allows for longer holding periods, focusing on capturing larger price moves than day trading.

How does Swing Trading for Dummies differentiate between swing trading and day trading?

- Holding Period: Swing trading involves holding positions for several days or weeks, unlike day trading, which closes positions daily.

- Analysis Focus: Swing traders use technical analysis for trends and patterns, while day traders focus on short-term price movements.

- Risk Management: Swing traders can be less reactive to daily fluctuations, allowing for a more strategic approach.

What are the two main strategies for swing trading discussed in Swing Trading for Dummies?

- Technical Analysis: Involves analyzing price charts and using indicators based on historical price movements and patterns.

- Fundamental Analysis: Focuses on a company's financial health and market position, assessing earnings, sales growth, and industry trends.

- Combining Strategies: Encourages using both strategies together for enhanced effectiveness.

What is the significance of risk management in Swing Trading for Dummies?

- Foundation of Success: Chapter 10 is highlighted as the most important, focusing on effective risk management.

- Profitability Despite Mistakes: A solid risk management strategy can lead to profitability even with poor decisions.

- Setting Limits: Advises setting clear limits on trade risk and portfolio exposure to prevent significant losses.

How can I develop a trading plan according to Swing Trading for Dummies?

- Outline Strategy: Detail the securities to trade, entry and exit criteria, and risk management methods.

- Performance Evaluation: Include methods for evaluating trading performance over time, allowing for adjustments.

- Stay Disciplined: Emphasizes sticking to the plan to avoid emotional decision-making and erratic behavior.

What is the Six Step Dance in Swing Trading for Dummies?

- Structured Analysis Method: A systematic approach to analyzing a company's stock to determine value.

- Key Steps: Includes understanding the industry, assessing financial stability, and valuing shares relative to competitors.

- Efficiency: Designed to be time-efficient, allowing quick evaluation of potential trades.

How do I determine my position size in swing trading?

- Risk Level Calculation: Position size is based on how much you're willing to lose, typically 0.25% to 2% of total capital.

- Stop Loss Level: Calculate the difference between entry price and stop loss to determine share quantity.

- Example Calculation: If entry is $40 and stop loss is $35, risk $5 per share; willing to risk $375, buy 75 shares.

What are common mistakes to avoid in swing trading?

- Overtrading: Trading too frequently can increase costs and lower returns; focus on quality trades.

- Ignoring Risk Management: Failing to set stop loss orders or position sizes can lead to significant losses.

- Chasing Losses: Doubling down on losing positions is dangerous; accept losses and move on to new opportunities.

Review Summary

Swing Trading for Dummies receives mixed reviews, with an average rating of 3.96/5. Readers appreciate its comprehensive coverage of swing trading basics, including trade planning, screening, and journaling. Many find it useful for beginners, praising its clear explanations and practical examples. However, some criticize its lack of depth in technical indicators and real-world trade examples. The book's focus on stock trading limits its utility for forex traders. Overall, readers value its content but note areas for improvement in writing style and specific trading strategies.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.