Key Takeaways

1. The stock market is unpredictable, but long-term investing works

"Speculation is an effort, probably unsuccessful, to turn a little money into a lot."

Long-term perspective: The stock market's short-term movements are inherently unpredictable. Attempting to time the market or make quick profits through frequent trading is often futile and can lead to substantial losses. Instead, investors should focus on the long-term growth potential of the overall market.

Compound growth: Over extended periods, major stock markets have consistently outperformed other asset classes like bonds or cash deposits. This is due to the power of compound interest, where returns generate additional returns over time. By staying invested through market ups and downs, investors can benefit from this compounding effect.

Key strategies:

- Invest regularly, regardless of market conditions (dollar-cost averaging)

- Reinvest dividends to accelerate compound growth

- Focus on low-cost index funds for broad market exposure

- Maintain a long-term investment horizon (5+ years minimum, ideally decades)

2. Speculation is risky, diversification is wise

"Wide diversification is only required when investors do not understand what they are doing."

Speculation vs. investment: Speculation involves taking large risks in hopes of quick, outsized gains. This approach is often driven by emotion and can lead to significant losses. True investment, on the other hand, focuses on owning a piece of quality businesses for the long-term.

Benefits of diversification: Spreading investments across different asset classes, industries, and geographical regions helps to reduce overall portfolio risk. While Warren Buffett argues against over-diversification for expert investors, most individuals benefit from a well-diversified approach.

Diversification strategies:

- Invest in low-cost index funds or ETFs for broad market exposure

- Include a mix of stocks, bonds, and potentially real estate

- Consider international markets for geographical diversification

- Rebalance periodically to maintain your target asset allocation

3. Professional stock-pickers rarely outperform the market consistently

"Thus far in our history there has been little evidence that there exists a demonstrable skill in managing security portfolios."

Active vs. passive management: Numerous studies have shown that actively managed funds, on average, underperform their benchmark indices over long periods. This is due to higher fees, transaction costs, and the difficulty of consistently making accurate predictions about individual stocks or market movements.

Index investing: Given the challenges of active management, many investors opt for low-cost index funds that simply track broad market indices. This passive approach provides market returns minus minimal fees and has proven effective for long-term wealth building.

Key considerations:

- Focus on low-cost index funds or ETFs for core portfolio holdings

- If using active managers, look for those with consistent long-term track records and reasonable fees

- Be skeptical of claims of market-beating abilities or "hot" investment strategies

4. Beware of investment hype and market bubbles

"Booms are bad things, not good. But nearly all of us have a secret hankering for another one."

Psychology of bubbles: Market bubbles occur when asset prices become disconnected from fundamental values, driven by excessive optimism and speculation. These periods of irrational exuberance can be seductive, but inevitably lead to painful corrections.

Identifying bubble warning signs:

- Rapid price increases without corresponding improvements in fundamentals

- Widespread belief that "this time is different"

- Easy credit and speculation using borrowed money

- New financial innovations promising unrealistic returns

Protecting yourself:

- Maintain a diversified portfolio to limit exposure to any single asset class

- Be cautious of investments you don't fully understand

- Avoid following the crowd or making decisions based on FOMO (fear of missing out)

- Remember that if something sounds too good to be true, it probably is

5. Focus on preserving capital and generating income

"A man's true wealth is his income, not his bank balance."

Capital preservation: For long-term financial security, protecting your principal investment should be a primary focus. This means avoiding unnecessary risks and prioritizing steady, sustainable growth over potential "home run" investments.

Income generation: Building a portfolio that provides reliable income through dividends, interest payments, or rental income can provide financial stability and reduce reliance on market appreciation alone.

Strategies for capital preservation and income:

- Maintain an emergency fund in safe, liquid assets

- Invest in high-quality, dividend-paying stocks or dividend-focused ETFs

- Consider bonds or bond funds for fixed income

- Explore real estate investment trusts (REITs) for property-based income

- As you approach retirement, gradually shift towards more conservative, income-producing investments

6. Understand the basics: compound interest, inflation, and risk

"The most powerful force in the universe is compound interest."

Compound interest: This concept is the foundation of long-term wealth building. By reinvesting returns, your money grows exponentially over time. The earlier you start investing, the more powerful this effect becomes.

Inflation awareness: Always consider the impact of inflation on your investments and purchasing power. Aim for returns that outpace inflation to grow your wealth in real terms.

Risk and return: Generally, higher potential returns come with increased risk. Understanding your personal risk tolerance and investment timeline is crucial for building an appropriate portfolio.

Key financial concepts:

- Rule of 72: Divide 72 by your annual return to estimate how long it takes money to double

- Real returns: Subtract inflation from nominal returns to understand actual purchasing power growth

- Risk-adjusted returns: Consider the level of risk taken to achieve given returns

- Diversification: Spreading investments reduces overall portfolio risk

7. Be skeptical of financial "experts" and their predictions

"Never ask a barber if you need a haircut."

Conflicts of interest: Many financial professionals have incentives that may not align with your best interests. They may promote certain products or strategies to generate fees or commissions rather than maximize your returns.

Limitations of predictions: The financial media and "expert" analysts constantly make predictions about market movements or individual stocks. These forecasts are often no more accurate than random guesses, yet can influence investor behavior.

Protecting yourself:

- Seek out fiduciary advisors who are legally obligated to act in your best interest

- Be wary of "hot tips" or promises of guaranteed returns

- Focus on your long-term financial plan rather than short-term market noise

- Educate yourself on basic financial concepts to make informed decisions

8. Mergers and acquisitions often disappoint

"Mega-mergers are for megalomaniacs."

M&A challenges: While mergers and acquisitions are often touted as creating synergies and value, the reality is that many fail to deliver on their promises. Cultural clashes, integration difficulties, and overestimated cost savings can lead to disappointing results.

Investor implications:

- Be cautious of companies engaging in frequent or large acquisitions

- Look for companies with a track record of successful, strategic M&A activity

- When your company is acquired, consider taking profits rather than holding the combined entity

- Focus on organic growth potential rather than growth through acquisition

Red flags in M&A:

- Overpaying for acquisitions

- Mergers between direct competitors (may face regulatory hurdles)

- Acquisitions outside a company's core competencies

- Deals driven by ego or empire-building rather than strategic fit

9. Company financials can be misleading

"Earnings can be pliable as putty when a charlatan heads the company reporting them."

Creative accounting: Companies sometimes use aggressive or misleading accounting practices to present their financial results in the best possible light. This can make it difficult for investors to accurately assess a company's true financial health.

Earnings management: Executives may manipulate reported earnings to meet analyst expectations or hit bonus targets. This can involve shifting revenues or expenses between periods, changing accounting estimates, or using non-GAAP metrics.

Due diligence strategies:

- Focus on cash flow statements, which are harder to manipulate than income statements

- Look for consistent accounting practices over time

- Be wary of frequent "one-time" charges or adjustments

- Compare a company's financials to industry peers

- Read the footnotes and management discussion in annual reports

- Consider using forensic accounting tools or services for in-depth analysis

10. Invest in what you understand and for the long-term

"Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now."

Circle of competence: Focus your investments on businesses and industries you truly understand. This knowledge gives you an edge in evaluating a company's competitive position and long-term prospects.

Long-term orientation: View stock purchases as buying a piece of a business, not just a ticker symbol. This mindset encourages patience and helps you ignore short-term market noise.

Investment approach:

- Develop expertise in specific industries or sectors

- Look for companies with durable competitive advantages ("moats")

- Focus on businesses with long runways for growth

- Be willing to hold investments for years or decades

- Ignore short-term price fluctuations if the underlying business remains strong

- Continuously educate yourself about your investments and potential opportunities

Last updated:

FAQ

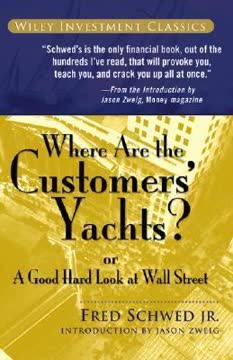

What's "Where Are the Customers' Yachts?" about?

- Investment Industry Critique: The book offers a humorous yet critical look at the investment industry, questioning the value of financial advice provided by professionals.

- Historical Context: Written by Fred Schwed Jr., it reflects on the stock market dynamics during the 1920s and 1930s, drawing parallels to modern financial crises.

- Title's Origin: The title refers to a joke about how financial professionals own yachts, but their clients do not, highlighting the disparity in wealth creation.

- Timeless Wisdom: Despite being published in 1940, the book's insights into human behavior and market psychology remain relevant today.

Why should I read "Where Are the Customers' Yachts?" by Fred Schwed Jr.?

- Humorous Insight: The book provides a witty and entertaining perspective on the financial world, making complex topics accessible.

- Timeless Lessons: It offers enduring lessons on the pitfalls of investing and the limitations of financial advice.

- Cynical Yet Realistic: Schwed's skepticism about the financial industry's ability to predict market movements is both humorous and thought-provoking.

- Historical Perspective: Understanding past financial crises can provide valuable insights into current market dynamics.

What are the key takeaways of "Where Are the Customers' Yachts?"?

- Skepticism of Expertise: The book questions the ability of financial professionals to consistently outperform the market.

- Market Unpredictability: Schwed emphasizes that markets are inherently unpredictable, and trying to beat the average often leads to trouble.

- Investment Caution: The book advises against speculative investments and highlights the importance of preserving capital.

- Human Nature in Finance: It explores how human behavior, such as greed and fear, influences market dynamics.

What are the best quotes from "Where Are the Customers' Yachts?" and what do they mean?

- "Speculation is an effort, probably unsuccessful, to turn a little money into a lot." This quote highlights the risky nature of speculation and the low probability of success.

- "Investment is an effort, which should be successful, to prevent a lot of money from becoming a little." It underscores the importance of preserving capital rather than seeking high returns.

- "The stock market … not being a physical thing, is not subject to Newton’s laws of propulsion or inertia." This quote humorously points out that market movements are not predictable like physical objects.

- "The crookedness of Wall Street is in my opinion an overrated phenomenon." Schwed suggests that while there are dishonest practices, the real issue is the unrealistic expectations of investors.

How does Fred Schwed Jr. view professional stock-picking in "Where Are the Customers' Yachts?"?

- Skeptical View: Schwed is skeptical about the ability of professional stock-pickers to consistently outperform the market.

- Lack of Evidence: He argues that there is little evidence to support the notion that professional managers possess a special skill in stock-picking.

- Market Average: Most funds perform worse than the market average, and even those that outperform struggle to maintain it over time.

- Chance Exceptions: While there are exceptions, Schwed suggests these are often due to chance rather than skill.

What does "Where Are the Customers' Yachts?" say about market unpredictability?

- Unpredictable Nature: Schwed emphasizes that markets are inherently unpredictable and not subject to physical laws.

- Long-Term Investing: He suggests that investing for the long haul is more reliable than trying to time the market.

- Human Behavior: The book explores how human emotions like greed and fear contribute to market volatility.

- Avoiding Speculation: Schwed advises against speculative investments, which often lead to losses.

What advice does Fred Schwed Jr. give about speculation in "Where Are the Customers' Yachts?"?

- High Risk: Speculation is portrayed as a high-risk activity with a low probability of success.

- Human Nature: Schwed notes that human nature often leads people to speculate, especially during market booms.

- Beginner's Mistake: He warns that beginners often mistake speculation for investment, leading to losses.

- Knowledge Advantage: Successful speculation requires better knowledge than others, which is rare in major stock markets.

How does "Where Are the Customers' Yachts?" address the concept of diversification?

- Misleading Simplicity: Schwed suggests that the argument for diversification is more complex than it appears.

- Adequate Diversification: He notes that a holding of as few as 20 shares can provide adequate diversification.

- Over-Diversification: Excessive diversification can reduce potential returns without significantly lowering risk.

- International Diversification: Schwed highlights the importance of diversifying across different regions and markets.

What does "Where Are the Customers' Yachts?" say about the role of financial regulators?

- Political Pressure: Regulators are often pressured to appear proactive, especially during financial crises.

- Overzealous or Lax: Schwed critiques regulators for being either too zealous or too lax in their enforcement.

- Regulatory Challenges: The book acknowledges the difficulty regulators face in balancing oversight with market freedom.

- Derivatives Concern: Schwed raises concerns about the lack of regulation in the derivatives market, which poses systemic risks.

How does Fred Schwed Jr. view the concept of long-term investing in "Where Are the Customers' Yachts?"?

- Compounding Benefits: Long-term investing benefits from the power of compound interest, leading to significant growth over time.

- Patience Required: Schwed emphasizes the importance of patience and holding investments for the long term.

- Market Growth: He suggests that, despite short-term volatility, major stock markets perform well in the long term.

- Avoiding Short-Termism: The book advises against frequent trading, which incurs high transaction costs and reduces returns.

What insights does "Where Are the Customers' Yachts?" provide on the psychology of investors?

- Behavioral Finance: Schwed explores how irrational behavior and emotions influence investment decisions.

- Regression to the Mean: He discusses the tendency for extraordinary returns to revert to the average over time.

- Herd Mentality: The book highlights how investors often follow trends, leading to market bubbles and crashes.

- Cautious Optimism: Schwed advises maintaining a balanced perspective, avoiding both excessive optimism and pessimism.

What does "Where Are the Customers' Yachts?" say about the importance of understanding financial concepts?

- Numeracy Required: Schwed stresses the importance of understanding probability and risk in investing.

- Risk Adjustment: Investors should be aware of the variance in returns and adjust for risk accordingly.

- Avoiding Misleading Information: The book warns against relying on overly complex or misleading financial predictions.

- Informed Decisions: Schwed encourages investors to educate themselves and make informed decisions based on sound reasoning.

Review Summary

"Where Are the Customers' Yachts?" is widely praised as a timeless, humorous critique of Wall Street. Readers appreciate its witty insights into financial folly, noting its continued relevance decades after publication. Many find it entertaining and enlightening, recommending it as essential reading for investors. The book's satire exposes industry practices and human nature in finance. While most reviewers highly rate it, a few find it less useful or overly critical. Overall, it's considered a classic that offers valuable lessons through humor.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.