Key Takeaways

1. Redefine success: Break free from consumer culture and societal expectations

"Success is then redefined from accumulating and consuming the maximum number of products or the most expensive products to deriving the maximum utility."

Challenge societal norms. Our culture equates success with material possessions, high-paying jobs, and constant consumption. This mindset traps people in a cycle of working to spend and spending to work, leaving little time for personal growth or meaningful experiences.

Redefine wealth and happiness. True wealth comes from having control over your time, pursuing personal interests, and developing meaningful relationships. By shifting focus from accumulating stuff to accumulating experiences and knowledge, you can achieve a more fulfilling life with less financial burden.

Embrace simplicity and intentionality. Evaluate your needs versus wants, and consciously choose how to allocate your resources. This doesn't mean living in deprivation, but rather being mindful of your consumption and prioritizing what truly brings value to your life.

2. Adopt a Renaissance mindset: Cultivate diverse skills and knowledge

"The Renaissance man is capable of many different things and doesn't restrict himself to vocational skills."

Become a polymath. Develop a wide range of skills and knowledge across various disciplines. This approach not only makes you more self-reliant but also enhances your problem-solving abilities and creativity.

Embrace lifelong learning. Continuously seek out new knowledge and experiences. This can include:

- Learning practical skills (e.g., cooking, home repair, basic car maintenance)

- Studying diverse subjects (e.g., history, science, philosophy, arts)

- Developing physical abilities (e.g., strength training, flexibility, endurance)

Create synergies between skills. Look for ways to combine your diverse knowledge and abilities to create unique solutions and opportunities. This interdisciplinary approach can lead to innovative ideas and a more adaptable lifestyle.

3. Maximize savings rate: Achieve financial independence in 5-10 years

"Saving three quarters of one's income creates financial independence in about five years!"

Radically increase your savings rate. The key to early financial independence is not earning more, but spending less. Aim to save 50-75% of your income, which can lead to financial independence in 5-10 years.

Reframe expenses as life energy. For every purchase, calculate how many hours of work it costs you. This perspective helps you make more intentional spending decisions and prioritize what truly matters.

Invest wisely for long-term growth. Once you've maximized your savings rate:

- Educate yourself on investment principles and strategies

- Choose low-cost, diversified index funds for long-term growth

- Consider real estate or other income-producing assets

- Regularly rebalance your portfolio to maintain your desired asset allocation

4. Optimize living arrangements: Reduce expenses without sacrificing quality of life

"Living in something significantly more economically efficient, smaller and more conveniently located than what your peers are living in is key to financial independence."

Rethink housing needs. Choose a living space that's efficient, affordable, and suits your lifestyle. Consider:

- Downsizing to a smaller home or apartment

- House-hacking (e.g., renting out spare rooms)

- Alternative housing options (e.g., tiny homes, RVs, boat living)

Prioritize location. Live close to work, amenities, and public transportation to reduce commuting costs and time. This often means choosing a smaller space in a better location over a larger home in the suburbs.

Optimize energy efficiency. Reduce utility costs by:

- Improving insulation and weatherproofing

- Using energy-efficient appliances and lighting

- Adopting habits that minimize energy consumption

5. Rethink transportation: Embrace alternatives to car ownership

"By changing your eating habits from refrigerated and frozen food to a diet of fresh food and staples, you'll be able to get away with a much smaller refrigerator."

Question car dependency. Evaluate whether you truly need a car or if alternative transportation methods could work for your lifestyle. Consider:

- Walking or cycling for short trips

- Using public transportation for longer journeys

- Car-sharing or occasional car rentals for specific needs

Optimize food storage and preparation. Rethink your kitchen setup to reduce energy consumption and food waste:

- Adopt a "fresh food" approach, shopping more frequently for smaller quantities

- Learn preservation techniques (e.g., canning, fermenting) for long-term storage without refrigeration

- Use energy-efficient cooking methods (e.g., pressure cookers, solar ovens)

Embrace minimalism in the kitchen. Simplify your kitchen tools and appliances, focusing on versatile, high-quality items that serve multiple purposes. This reduces clutter, saves money, and encourages creativity in cooking.

6. Master personal finance: Understand key ratios and investment principles

"The conclusion here is that the higher the ratio of savings rate to needs, the safer one is from emergencies."

Understand key financial ratios. Focus on:

- Savings rate: Aim for 50-75% of income

- Emergency fund: 3-6 months of essential expenses

- Withdrawal rate: 3-4% of portfolio for sustainable retirement

Grasp investment fundamentals. Educate yourself on:

- Asset allocation and diversification

- Risk tolerance and time horizon

- The power of compound interest

- Tax-efficient investing strategies

Develop a long-term investment strategy. Create a plan that aligns with your goals and risk tolerance, focusing on low-cost index funds or other passive investment vehicles. Regularly review and rebalance your portfolio to stay on track.

7. Develop resilience: Create multiple income streams and adaptable skills

"A Renaissance man is a person who is competent in a wide range of fields, covering intellectual areas as well as the arts, physical fitness, and social accomplishments."

Diversify income sources. Reduce reliance on a single job by developing multiple income streams:

- Freelance or consulting work in your field of expertise

- Rental income from real estate investments

- Dividends and interest from investment portfolio

- Side businesses or entrepreneurial ventures

Cultivate adaptable skills. Focus on developing transferable skills that are valuable across various industries and situations:

- Communication and interpersonal skills

- Problem-solving and critical thinking

- Digital literacy and technology skills

- Project management and organization

Build a robust professional network. Maintain relationships with colleagues, mentors, and industry contacts. A strong network can provide opportunities, support, and valuable insights throughout your career.

8. Cultivate meaningful relationships: Navigate social challenges of an unconventional lifestyle

"To live together, a couple has to agree on certain things, like not signing up for debt, and how much to spend on common items like housing."

Communicate openly about financial goals. When pursuing financial independence, it's crucial to have open and honest discussions with your partner, family, and close friends about your goals and lifestyle choices.

Find like-minded communities. Seek out others who share your values and aspirations:

- Join online forums and local meetups focused on financial independence

- Participate in skill-sharing groups or co-ops

- Engage in volunteer work or community organizations aligned with your values

Navigate social expectations. Be prepared to explain your choices to others who may not understand your lifestyle:

- Develop confident, concise responses to common questions or criticisms

- Focus on the positive aspects of your choices, such as increased freedom and reduced stress

- Lead by example, demonstrating the benefits of your lifestyle through your actions and attitude

Last updated:

FAQ

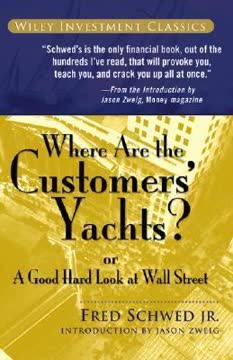

What's Early Retirement Extreme about?

- Philosophical and Practical Guide: Early Retirement Extreme by Jacob Lund Fisker is both a philosophical and practical guide to achieving financial independence and early retirement.

- Focus on Understanding: It emphasizes understanding the "why" behind financial decisions, not just the "how," encouraging readers to develop their own strategies.

- Renaissance Ideal: The book promotes becoming a modern Renaissance person, skilled in various areas, to allow for greater flexibility and independence.

Why should I read Early Retirement Extreme?

- Challenge Conventional Wisdom: The book challenges traditional views on work, consumption, and retirement, prompting readers to rethink their life choices.

- Achieve Financial Independence: It offers insights on drastically reducing living expenses to achieve financial independence, often within five years.

- Broader Life Perspective: Readers gain a broader perspective, focusing on experiences and personal growth over material accumulation for a more fulfilling life.

What are the key takeaways of Early Retirement Extreme?

- Decoupling from Consumerism: The book stresses the importance of reducing unnecessary expenses to achieve financial freedom.

- Modular Lifestyle Design: It introduces a lifestyle where different life aspects are interconnected yet independent, enhancing resilience and adaptability.

- Focus on Skills and Knowledge: Developing a wide range of skills reduces marketplace dependence and enhances personal agency.

How does Early Retirement Extreme define financial independence?

- Living Below Means: Financial independence is living on a fraction of one's income, allowing for early retirement or less work.

- Investment Income: Generating passive income through investments is crucial to cover living expenses without traditional employment.

- Self-Sufficiency: Achieving financial independence involves becoming self-sufficient in various life skills, reducing reliance on external services.

What specific methods does Jacob Lund Fisker recommend for achieving early retirement?

- Maximize Return on Effort: Focus on projects yielding the highest returns relative to effort, using mathematical models to guide decisions.

- Reduce Wants and Needs: Minimize consumption and simplify life to create a larger gap between income and expenses, accelerating savings.

- Invest in Skills: Develop practical skills to reduce reliance on paid services, saving money and increasing self-sufficiency.

What are the barriers to change discussed in Early Retirement Extreme?

- Mental and Social Barriers: Fear of change and social disapproval are significant obstacles to adopting a new lifestyle.

- Lock-in Effect: Individuals can become trapped in current lifestyles due to financial commitments and societal expectations.

- Need for a Strong Vision: Overcoming these barriers requires a strong vision of the desired future and practical steps towards achieving it.

How does the S-curve concept apply to financial independence in Early Retirement Extreme?

- Understanding Returns: The S-curve illustrates varying returns on effort, with exponential growth possible when initial investments are made wisely.

- Effort Allocation: At different project stages, the relationship between effort and results changes, suggesting strategic effort allocation is key.

- Avoiding Diminishing Returns: The concept warns against overextending efforts in areas with limited returns, encouraging project diversification.

What strategies does Early Retirement Extreme suggest for reducing expenses?

- Minimalism and Frugality: Advocate for a minimalist lifestyle, focusing on owning only what is truly needed and valued.

- DIY Approach: Encourage a do-it-yourself approach to life aspects like cooking and home repairs to save money and build skills.

- Community and Sharing: Leverage community resources, such as bartering and sharing, to meet needs without incurring costs.

How does Early Retirement Extreme address the concept of consumerism?

- Critique of Consumer Culture: Fisker critiques societal pressure to consume, arguing it leads to financial dependence and dissatisfaction.

- Encouragement of Minimalism: Promotes minimalism to break free from consumerism, suggesting reduced wants lead to greater happiness.

- Focus on Experiences Over Things: Prioritize experiences and personal growth over material possessions for a more fulfilling life.

What role does investing play in achieving early retirement according to Early Retirement Extreme?

- Building Wealth Through Assets: Emphasizes investing in income-generating assets for financial security and independence.

- Understanding Risk and Return: Discusses the relationship between risk and return, advising informed and strategic investment choices.

- Long-term Perspective: Encourages a long-term view of investing, highlighting the benefits of patience and compounding returns.

What are the best quotes from Early Retirement Extreme and what do they mean?

- Mindset Shift: "You can’t solve your problems with the same mindset that created them." Emphasizes the need for a shift in thinking to break free from consumerism.

- Creative Problem Solving: "The best way to find new insights into a problem was to step out of the box." Encourages thinking creatively and exploring unconventional solutions.

- Life as a Vehicle: "Living is thought of as driving a particular kind of 'vehicle'." Illustrates that life can be navigated in various ways, leading to greater freedom and satisfaction.

How can I apply the principles from Early Retirement Extreme to my own life?

- Assess Your Spending: Evaluate current expenses and identify areas to cut back to increase savings.

- Set Clear Goals: Define financial independence goals and create a plan aligning with values and desired lifestyle.

- Educate Yourself: Learn about personal finance, investing, and practical skills to reduce costs and increase self-sufficiency.

Review Summary

Early Retirement Extreme receives mixed reviews, with some praising its philosophical approach to financial independence and frugal living, while others find it too extreme or poorly organized. Readers appreciate the book's challenge to consumerism and conventional retirement planning, but some struggle with its dense, scientific writing style. Many find value in its unconventional ideas about lifestyle design and resource management, though the practical advice is often considered too radical for most. Overall, it's seen as a thought-provoking read that may not appeal to everyone.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.