Key Takeaways

1. Pay Yourself First: The Foundation of Wealth

In found the road to wealth when I decided that a part of all I earned was mine to keep.

Prioritize savings. The cornerstone of wealth accumulation is consistently setting aside a portion of your income before paying any other expenses. This principle emphasizes that your financial future should be a priority, not an afterthought.

The 10% rule. Arkad advises saving at least 10% of every earning. This seemingly small amount, when consistently saved, forms the seed from which wealth grows. It's a tangible commitment to your financial well-being.

Automate savings. To make this principle easier to follow, automate your savings by setting up a direct transfer from your paycheck to a savings or investment account. This removes the temptation to spend the money and ensures consistent savings.

2. Control Spending: Distinguish Needs from Desires

Do not confuse your necessary expenses with your desires.

Budgeting is essential. Creating a budget is crucial for understanding where your money goes and identifying areas where you can cut back. A budget helps you distinguish between essential expenses and discretionary spending.

Needs vs. desires. Differentiate between what you need to survive and what you want for pleasure. Needs are essential for survival, such as food, shelter, and clothing. Desires are non-essential items that add comfort or luxury to your life.

Limitless desires. Recognize that desires are limitless, but resources are finite. Prioritize your spending based on your financial goals and values. Avoid the trap of keeping up with the Joneses, which can lead to overspending and debt.

3. Invest Wisely: Make Your Gold Multiply

Every gold coin you save is a slave that works for you.

Gold as a worker. Savings should not be hoarded but invested to generate more income. Each coin saved becomes a "slave" working to produce more wealth through interest, dividends, or capital appreciation.

Seek expert advice. Before investing, seek advice from knowledgeable and experienced individuals. Avoid taking investment advice from those who lack expertise, as this can lead to costly mistakes.

Reinvest earnings. Reinvest the earnings from your investments to accelerate wealth accumulation. This compounding effect allows your wealth to grow exponentially over time.

4. Protect Your Treasure: Secure Your Investments

The first principle of investment is to assure your principal.

Capital preservation. The primary goal of investing should be to protect your initial investment. Avoid high-risk investments that could result in significant losses.

Diversification. Spread your investments across different asset classes to reduce risk. Diversification helps to mitigate the impact of any single investment performing poorly.

Due diligence. Thoroughly research any investment opportunity before committing your capital. Understand the risks involved and ensure that the investment aligns with your financial goals and risk tolerance.

5. Own Your Home: A Profitable Investment

I recommend that every man own the roof that shelters him and his family.

Homeownership benefits. Owning a home provides stability, security, and a sense of pride. It can also be a profitable investment over the long term.

Reduced living costs. Homeownership can reduce your monthly living expenses by eliminating rent payments. The money saved can be used for other investments or to pay down the mortgage faster.

Building equity. As you pay down your mortgage, you build equity in your home. This equity can be borrowed against in the future for other investments or expenses.

6. Secure Future Income: Plan for Old Age

A man must provide adequately for his old age and for the protection of his family.

Long-term planning. It's essential to plan for your financial future, including retirement and the protection of your family in case of unforeseen circumstances.

Retirement savings. Start saving for retirement early and consistently. Take advantage of employer-sponsored retirement plans and other tax-advantaged savings vehicles.

Insurance protection. Purchase life insurance to protect your family in the event of your death. Also, consider disability insurance to protect your income if you become unable to work.

7. Cultivate Knowledge: Enhance Your Earning Power

The more of wisdom we know, the more we may earn.

Continuous learning. Invest in your education and skills to increase your earning potential. The more valuable your skills, the more you can command in the marketplace.

Master your craft. Strive to become an expert in your field. The more skilled you are, the more opportunities will come your way.

Seek self-improvement. Continuously seek ways to improve yourself, both personally and professionally. This could involve reading books, attending seminars, or taking online courses.

8. Luck Favors the Prepared: Seize Opportunities

Opportunity is a haughty goddess who wastes no time with those who are unprepared.

Be ready to act. Luck often comes in the form of opportunity, but it's up to you to seize it. Be prepared to act quickly and decisively when an opportunity presents itself.

Develop skills. Develop the skills and knowledge necessary to take advantage of opportunities. The more prepared you are, the more likely you are to succeed.

Take calculated risks. Don't be afraid to take calculated risks. Sometimes, the greatest rewards come from taking a chance on a promising opportunity.

9. Overcome Procrastination: Act Decisively

Action will lead thee forward to the successes thou dost desire.

Avoid delaying decisions. Procrastination can lead to missed opportunities and financial losses. Make decisions promptly and decisively.

Take immediate action. When you identify a good opportunity, take immediate action to pursue it. Don't let fear or doubt hold you back.

Break down tasks. If you're feeling overwhelmed, break down large tasks into smaller, more manageable steps. This can make it easier to get started and maintain momentum.

10. Wealth Increases Expands with Energetic Spending

Wealth increases whenever men exert energy.

Wealth creation. Wealth is not a finite resource. It increases as people spend their energy and resources to create value.

Economic activity. Spending money on goods and services stimulates economic activity, creating jobs and opportunities for others.

Invest in growth. Invest in businesses and projects that create value and contribute to economic growth. This can lead to increased wealth for both individuals and society as a whole.

Last updated:

Review Summary

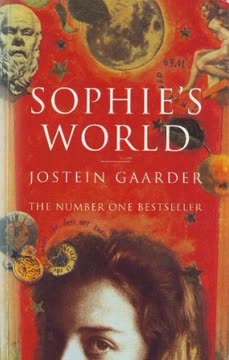

El Hombre Mas Rico de Babilonia is highly regarded for its timeless financial advice presented through engaging stories set in ancient Babylon. Readers appreciate its simplicity, practicality, and relevance to modern life. Key lessons include saving 10% of income, investing wisely, and continuous learning. Many find the book inspirational and life-changing, praising its ability to teach financial principles through storytelling. Some critics find it basic or repetitive, but most consider it an excellent introduction to personal finance, with enduring wisdom applicable across generations.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.