Key Takeaways

1. Global macro investing: A flexible approach to worldwide opportunities

"Global macro is the willingness to opportunistically look at every idea that comes along, from micro situations to country-specific situations, across every asset category and every country in the world."

Broad perspective. Global macro investing involves analyzing macroeconomic trends and geopolitical events to identify investment opportunities across various asset classes and geographical regions. This approach allows investors to capitalize on global economic shifts, currency fluctuations, and policy changes.

Flexibility is key. Successful global macro investors remain adaptable, constantly reassessing their views and adjusting their positions as market conditions evolve. They are not constrained by specific asset classes or regions, allowing them to pursue the most attractive opportunities wherever they may arise.

Examples of global macro opportunities:

- Currency trades based on diverging monetary policies

- Commodity investments driven by supply and demand imbalances

- Equity positions reflecting changing economic landscapes in emerging markets

- Fixed income trades capitalizing on interest rate differentials between countries

2. The importance of understanding market psychology and behavioral finance

"Markets are based on two emotions: fear and greed. The greed part is nice when you're a part of it and are invested, but when fear takes over, it's an unbelievable thing."

Emotional drivers. Market movements are often influenced by collective human behavior rather than purely rational decision-making. Understanding the psychological factors that drive investor sentiment can provide valuable insights into market trends and potential turning points.

Contrarian thinking. Successful global macro investors often take positions that go against prevailing market sentiment, recognizing that extreme fear or greed can create mispriced assets and opportunities for profit.

Key behavioral finance concepts to consider:

- Herd mentality: The tendency for investors to follow the crowd

- Overconfidence bias: Overestimating one's ability to predict market movements

- Loss aversion: The tendency to feel losses more strongly than equivalent gains

- Anchoring: Relying too heavily on one piece of information when making decisions

3. Central banks' role in shaping global economic landscapes

"Central bankers have nearly always been wrong. I mean, remember they are bureaucrats. If they could get a real job, they would not be working for the government."

Policy influence. Central banks play a crucial role in shaping economic conditions through monetary policy decisions, such as setting interest rates and implementing quantitative easing programs. These actions can have far-reaching effects on currency values, asset prices, and overall economic growth.

Anticipating policy shifts. Successful global macro investors strive to anticipate changes in central bank policies and their potential impact on financial markets. This often involves analyzing economic data, studying central bank communications, and understanding the unique challenges facing different economies.

Key central bank considerations:

- Interest rate decisions and their impact on currency values

- Quantitative easing programs and their effects on asset prices

- Forward guidance and its influence on market expectations

- The balance between inflation control and economic growth

4. The evolution of commodity markets and their impact on global economies

"We are watching the Asian miracle. The largest populations in the world are getting to an economic level where the gross domestic product (GDP) per capita is moving into the materials-intensive phase of economic growth."

Structural changes. The global commodity landscape has undergone significant transformations in recent decades, driven by factors such as technological advancements, shifting supply and demand dynamics, and the rise of emerging market economies.

Economic implications. Commodity price movements can have profound effects on both commodity-exporting and commodity-importing nations, influencing inflation rates, trade balances, and overall economic growth. Understanding these dynamics is crucial for global macro investors seeking to capitalize on long-term trends.

Key commodity market trends:

- The impact of renewable energy on traditional fossil fuel markets

- The growing importance of rare earth elements in technology industries

- Changing agricultural patterns due to climate change and population growth

- The influence of emerging market demand on global commodity prices

5. Adapting investment strategies to changing market conditions

"You've got to have enough sense of yourself to be proud of what you do, but if you can't admit that you're wrong, you have no chance in this business."

Flexibility and humility. Successful global macro investors remain open to changing their views and adapting their strategies as market conditions evolve. This requires a willingness to admit mistakes, reassess assumptions, and continuously learn from both successes and failures.

Balancing conviction and adaptability. While it's important to have strong convictions based on thorough analysis, investors must also be prepared to adjust their positions when new information challenges their initial thesis. This balance between conviction and flexibility is crucial for long-term success in global macro investing.

Strategies for adapting to changing markets:

- Regularly reassessing investment theses and challenging assumptions

- Maintaining a diverse set of information sources to gain different perspectives

- Implementing risk management techniques to limit downside during periods of uncertainty

- Cultivating a learning mindset and being open to new ideas and approaches

6. The significance of thorough research and primary information gathering

"We get the best information from the people in the industry. They know their economics, they know their businesses, and they know what's going on."

First-hand knowledge. Successful global macro investors often rely on primary research and direct contact with industry insiders to gain unique insights into market dynamics and potential investment opportunities. This approach can provide a competitive edge over those relying solely on secondary sources.

Diverse information sources. Gathering information from a wide range of sources, including industry experts, company management, government officials, and on-the-ground observations, can help investors develop a more comprehensive understanding of complex global issues.

Key research strategies:

- Conducting site visits to gain first-hand knowledge of local conditions

- Attending industry conferences and events to network and gather insights

- Cultivating relationships with experts across various fields and regions

- Analyzing unconventional data sources to identify emerging trends

7. Risk management: Balancing opportunity with potential downside

"The best fund managers are willing to be more of a mercenary with client money."

Risk-reward trade-offs. Successful global macro investing requires careful consideration of potential risks and rewards for each investment opportunity. This involves assessing factors such as position sizing, leverage, and correlation between different positions in a portfolio.

Downside protection. Implementing effective risk management strategies is crucial for preserving capital during market downturns and positioning portfolios for long-term success. This may involve using stop-loss orders, diversification, and hedging techniques to limit potential losses.

Key risk management considerations:

- Position sizing based on conviction level and potential downside

- Scenario analysis to assess the impact of various market outcomes

- Correlation analysis to ensure proper diversification across the portfolio

- Liquidity management to maintain the ability to adjust positions as needed

8. The interplay between geopolitics and financial markets

"Markets are like water. They will flow to the weakest point that they can push through, and they always do."

Global interconnections. Geopolitical events, such as trade disputes, elections, and international conflicts, can have significant impacts on financial markets across the globe. Understanding these dynamics is crucial for global macro investors seeking to anticipate and capitalize on market movements.

Identifying vulnerabilities. Successful investors often focus on identifying potential weaknesses in economic systems or political structures that could lead to market dislocations. This requires a deep understanding of global affairs and the ability to connect seemingly unrelated events.

Key geopolitical considerations:

- The impact of trade tensions on global supply chains and economic growth

- The influence of political instability on currency values and sovereign debt markets

- The effects of regulatory changes on specific industries or regions

- The potential for geopolitical events to trigger broader market contagion

9. Lessons from market crashes and financial crises

"I've learned that I did not know anything about trading even though I was supposedly smarter than everybody around me. I still had an enormous amount to learn."

Learning from mistakes. Market crashes and financial crises provide valuable lessons for investors, highlighting the importance of risk management, diversification, and maintaining a long-term perspective. Reflecting on past crises can help investors better prepare for future market turbulence.

Identifying patterns. While each crisis is unique, certain patterns often emerge during periods of market stress. Recognizing these patterns can help investors anticipate potential risks and opportunities during future market dislocations.

Key lessons from past crises:

- The danger of excessive leverage and overconfidence

- The importance of liquidity management during market stress

- The potential for contagion across seemingly unrelated asset classes

- The value of maintaining a contrarian perspective during periods of extreme sentiment

10. The future of global macro investing in an interconnected world

"I love the intellectual challenge of what I do. I am in a seat where almost everyone in the world is incented to teach me, whether it is a company, because it might want us to invest, or sell-side research staff, because it wants us to buy shares through its firm. I am constantly learning."

Evolving landscape. The global macro investing landscape continues to evolve, driven by factors such as technological advancements, changing market structures, and shifting geopolitical dynamics. Successful investors must adapt to these changes while maintaining their core analytical and decision-making skills.

Continuous learning. The complexity of global markets requires a commitment to lifelong learning and intellectual curiosity. Successful global macro investors cultivate a diverse network of information sources and remain open to new ideas and perspectives.

Key trends shaping the future of global macro investing:

- The growing importance of environmental, social, and governance (ESG) factors

- The impact of artificial intelligence and big data on investment analysis

- The potential for blockchain technology to transform financial markets

- The rise of new economic powers and shifting global power dynamics

Last updated:

FAQ

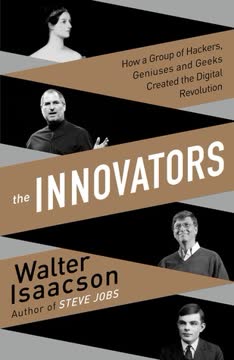

What's Inside the House of Money about?

- Focus on Hedge Funds: The book provides an in-depth exploration of hedge funds, particularly global macro strategies, through interviews with top traders.

- Diverse Perspectives: Each chapter features a different hedge fund manager, offering unique insights into their trading approaches and risk management techniques.

- Market Dynamics: It discusses how macroeconomic factors influence trading decisions and market movements, emphasizing the importance of understanding global economic conditions.

Why should I read Inside the House of Money?

- Real-World Insights: The book offers firsthand accounts from experienced hedge fund managers, providing practical knowledge applicable to personal investment strategies.

- Understanding Market Psychology: It delves into the psychological aspects of trading, highlighting how emotions and biases can affect decision-making.

- Timeless Lessons: The lessons shared are relevant across various market conditions, making it valuable for both novice and seasoned investors.

What are the key takeaways of Inside the House of Money?

- Diverse Strategies: There is no one-size-fits-all approach in hedge fund investing; each manager has a unique strategy reflecting their background and market outlook.

- Risk Management Importance: A recurring theme is the significance of risk management in trading, essential for long-term profitability.

- Market Dynamics: Understanding macroeconomic factors can help investors anticipate market changes and adjust their strategies accordingly.

What are the best quotes from Inside the House of Money and what do they mean?

- “Markets are always right.”: This underscores the importance of respecting market movements and not letting personal biases cloud judgment.

- “You can’t be afraid of losing.”: Reflects the necessity of accepting losses as part of trading, emphasizing learning from mistakes.

- “When everyone is saying something is inevitable, think twice.”: Cautions against herd mentality, encouraging independent thinking and skepticism.

How do hedge fund managers in Inside the House of Money approach risk management?

- Diverse Techniques: Managers employ various risk management strategies tailored to their specific investment styles, including strict exposure limits and hedging.

- Emphasis on Flexibility: Many stress the importance of being flexible and open-minded, adapting strategies based on market conditions.

- Continuous Monitoring: Effective risk management involves constant monitoring of market conditions and adjusting positions accordingly.

What is global macro investing as described in Inside the House of Money?

- Definition of Global Macro: A discretionary strategy that seeks to profit from macroeconomic trends across various asset classes, including equities, fixed income, currencies, and commodities.

- Flexibility in Strategy: Allows managers to take positions in any market or instrument, providing adaptability to changing conditions.

- Risk and Reward: Focuses on situations with favorable risk-reward ratios, requiring a deep understanding of market dynamics and economic indicators.

How do the traders in Inside the House of Money view market psychology?

- Emotional Influence: Traders recognize that emotions play a significant role in market movements, providing an edge in trading.

- Behavioral Patterns: Many study historical patterns to anticipate future market reactions, using insights on market sentiment.

- Contrarian Thinking: Successful traders often adopt contrarian views, betting against prevailing sentiment when it is irrational.

How do the interviews in Inside the House of Money enhance the reader's understanding of hedge funds?

- Personal Experiences: Interviews provide personal anecdotes and insights, making the content relatable and engaging.

- Diverse Perspectives: Each manager offers a unique perspective on trading strategies, risk management, and market analysis.

- Practical Advice: Managers share practical advice and lessons learned, offering valuable takeaways for improving investment strategies.

What role does market sentiment play in the strategies discussed in Inside the House of Money?

- Influence on Decision-Making: Market sentiment is a critical factor considered by many hedge fund managers when making investment decisions.

- Contrarian Strategies: Some managers bet against prevailing sentiment when they believe it is irrational, leading to significant profits.

- Psychological Factors: Successful investors manage their own emotions while understanding the emotions of other market participants.

How do the traders in Inside the House of Money handle losses?

- Quick Exit Strategy: Emphasize the importance of cutting losses quickly to prevent further damage to portfolios.

- Learning from Mistakes: View losses as learning opportunities, using them to refine strategies and improve performance.

- Maintaining Perspective: Maintain a long-term perspective, understanding that losses are a natural part of trading.

What are the challenges faced by hedge fund managers as described in Inside the House of Money?

- Market Volatility: Managers deal with unpredictable conditions that can lead to significant drawdowns, adapting strategies accordingly.

- Investor Expectations: Balancing expectations with market realities can be challenging, especially during turbulent times.

- Competition: The increasing number of hedge funds creates a competitive environment, requiring continuous innovation and refinement.

How does Inside the House of Money address the evolution of hedge funds?

- Historical Context: Provides an overview of hedge funds' evolution from speculative vehicles to sophisticated strategies.

- Changing Dynamics: Discusses how market dynamics, regulatory environments, and investor expectations have shaped the industry.

- Future Outlook: Speculates on the future of hedge funds, considering emerging trends and technologies impacting the industry.

Review Summary

Inside the House of Money offers a series of interviews with successful global macro hedge fund managers, providing insights into their trading strategies and market perspectives. Readers appreciate the candid discussions and technical insights, though some find the jargon challenging. The book is praised for its educational value, offering a glimpse into the world of high-level finance. Many reviewers found it particularly interesting as it was written just before the 2008 financial crisis, capturing the managers' predictions and concerns about upcoming market shifts.

Similar Books

Download PDF

Download EPUB

.epub digital book format is ideal for reading ebooks on phones, tablets, and e-readers.